- Regulatory & Compliance

- Special Cases

- Insights

- Useful documents

- Help! I’m subject to a tp audit

- I want to prepare for a TP Audit

- Regulatory & Compliance

- Special Cases

- Insights

- Useful documents

The Program act of 1 July 2016 introduced mandatory transfer pricing documentation requirements for certain multinationals. The reporting requirements have 3 objectives:

As in line with the OECD TP Guidelines, the documentation requirements consist of a three-tiered reporting scheme:

The Belgian legislator has translated this three-tiered approach in specific transfer pricing forms which have been published in the Belgian State Gazette of 2 December 2016:

|

Form |

Thresholds |

Timing |

|

275.MF |

To be completed in case in the preceding year at least one of the following criteria is exceeded (standalone basis): • Operational & financial revenue EUR 50 million • Balance sheet total of EUR 1 billion • Annual average number FTE’s of 100 |

no later than 12 months after the last day of the group’s reporting period concerned |

|

275.LF |

The form 275LF should be filed at the same time as the income tax return |

|

|

275.CbC |

To be completed in case in the preceding year the multinational group has realized a consolidated gross revenue of EUR 750 million or more |

no later than 12 months after the last day of the group’s reporting period concerned |

|

275.CBCNOT |

To be completed in case the Belgian taxpayer is part of a multinational group that needs to file the CBC report (in Belgium or abroad) |

no later than on the last day of the financial year of the Belgian entity; the Country-by-Country notification obligations for reporting periods ending as from 31 December 2019 (or later) will only be required if the information to be provided differs from the information that was provided in respect of the previous reporting period |

Note that these transfer pricing forms should be filed electronically in a valid XML format through the MyMinFinPro platform (and not via the Biztax platform used for the filing of the corporate income tax return).

Administrative fines are applicable in case of no filing, late filing and incomplete or inaccurate filing ranging from EUR 1.250 – 25.000 (as of second infringement in case except for cases in which the taxpayer acted in bad faith or had the intention to avoid tax).

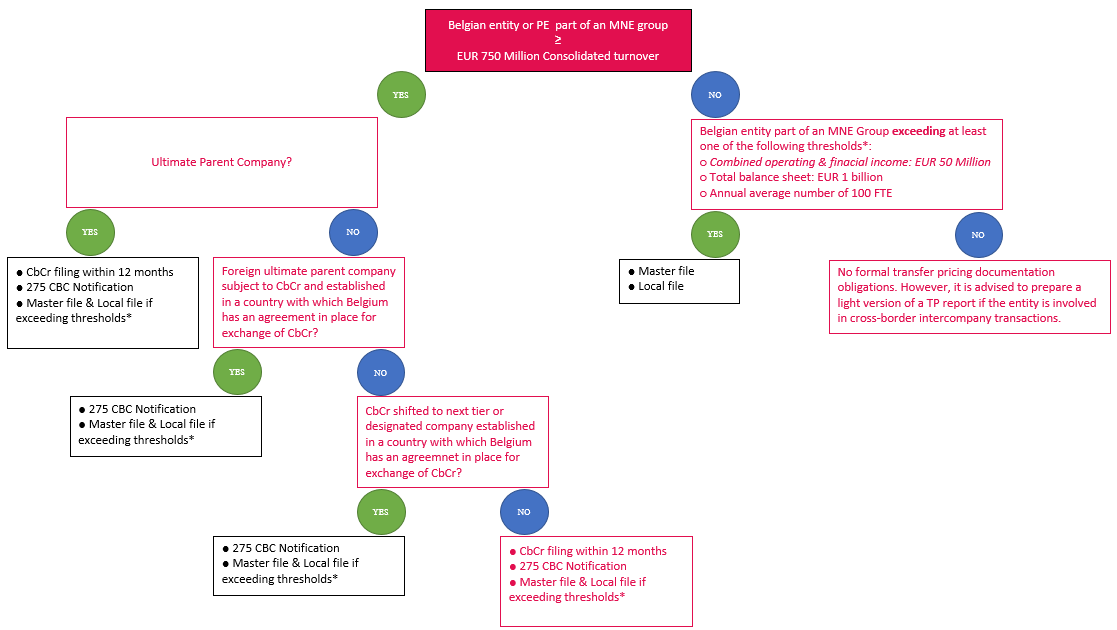

The following decision tree can allow you to assess whether your company needs to complete and file the specific transfer pricing forms:

KEY TIPS & TRICKS

- Consider thresholds on a yearly basis (especially when being close to certain thresholds)

- Timely preparation to avoid rush close to strict deadlines

- Assign appropriate roles for filing forms in the filing platform in due time to avoid rush close to the strict deadline

Considering the aforementioned value of having support of the arm’s length nature of its intercompany dealings, taxpayers can select various strategies with respect to transfer pricing documentation.

Such TP documentation strategy is to be determined based on a risk and costs/benefit assessment, ranging from merely obtaining compliance burdens, tactical defence memo to strategic full blown documentation.

KEY TIPS & TRICKS

- Perform a risk and cost assessment when selecting the TP documentation strategy

- Consider short deadlines to prepare reply to inquiries from tax authorities (in Belgium in principle 30 days) and the value add of having documentation available

Tour & Taxis

Havenlaan|Avenue du Port 86C B.419

BE-1000 Brussels

T +32 2 773 40 00

F +32 2 773 40 55

Grotesteenweg 214 B.4

BE-2600 Antwerp

T +32 3 443 20 00

F +32 3 443 20 20

23, Boulevard Joseph II

LU-1840 Luxembourg

T +352 27 47 51 11

F +352 27 47 51 10